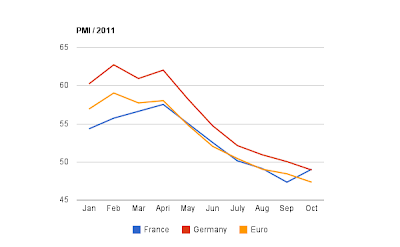

Well, the Euro PMI data came a little mixed, but to the downside, but the Industrial New Orders came higher than expected, so... Not looking too good for the EMU, but the situation is still not beyond salvage.

There was also positive flash PMI from China, which has helped to boost commodities, notably oil and copper. Looks like a risk-on scenario, but based on the same Euro plan-for-a-plan-that-we-already-know-won't-work, I'm not sure I will participate in the upswing; I don't like to chase momentum. Solvency is still and always will be the crux of the crisis, and unless that's solved, the efforts to maintain liquidity are useless, no matter how big the bazooka is. Italy seems to be flaking out on much-needed reforms, even with the Germans and ECB pressuring them to act; it will likely take their bond yields blowing out again to get them to act right...which doesn't seem too far from happening: 10-yr yields hit 5.95%, slightly below their unsustainable highs of 6.2% in early August. French-German spreads are also hitting all-time highs. ECB emergency lending is also near all-time highs, as are 2 year Euro swap spreads.

I'm having trouble reconciling the deteriorating liquidity and solvency picture in Europe with the equity and commodity risk-on trade. Does someone know something I don't? Is it Euro fatigue? Is the market really taking Yellen's call for QE3 seriously? Is there a serious chance of that happening near-term? Is this ramp-up just a set-up for a smack-down? I think its better to sit out until I can figure out what's going on...

No comments:

Post a Comment