On balance, the positives are all in the present. The negatives are all in the new orders. But I keep hearing "Q2 has been underwhelming, but we feel things will pick up in Q3 and Q4." Wouldn't that show up in New Orders data? In fact, we have seen the exact opposite in new orders data.

This post borrows heavily from sources such as Calafia Beach Pundit, Zerohedge, et. al. I didn't see a need to describe/chart public data if someone else has already done it, or summarize it, or reinvent the wheel, if someone else already has.

Positives

Employment

As Scott Grannis/Calafia Beach Pundit writes: "There is no way we are even close to a recession when the number of people working in the private sector grows at a 1.75% annual pace—or about 160K per month—and that is exactly what we have seen so far this year, according to the establishment survey. The increase in new jobs is disappointingly slow, to be sure, but it is not something that can be dismissed as meager or recessionary."

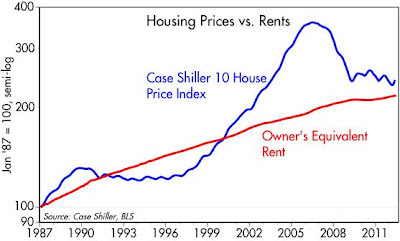

Housing

It looks like the worst is over in housing and most of the country will normalize. In fact, what is happening is a re-localization of housing prices based on local markets. The credit bubble drove prices up and down nationally; without artificial means of increasing/decreasing prices, supply and demand have again come in to play. "But what about all the unsold inventory? And the shadow inventory?" First, a lot of the "inventory" is localized to a few areas, like Phoenix, Michigan, Florida, etc. Second, a lot of the "inventory" will have to be razed due to deterioration (mortgage companies do a piss-poor job of maintaining properties, especially the ones they can't sell), so it isn't inventory at all. Finally, strong local markets - like Texas, the SF Bay area, etc. - are doing economically well, and people are migrating to these areas, so housing growth continues and will continue. The housing bust is over for the country, except for the most overbuilt areas during the boom.

Commercial and Industrial Lending

Again, Grannis sums it up well: "Commercial & Industrial Loans outstanding continue to rise at double-digit rates. Banks are relaxing lending standards, and companies are willing to borrow, a good sign of rising confidence, and a clear sign that credit conditions, which have been very restrictive, are improving."

Consumer Loan Delinquencies

Financial Conditions

Negatives

Inventory/Sales Ratio

Via Zerohedge: "With the first drop MoM since September 2011 and dramatically missing expectations, inventories dropped 0.2% and perhaps more worryingly - given the drop in inventories - is the critical inventory-to-sales ratio has now risen two months in a row as clearly sales are dropping faster than companies were expecting."

Consumer Comfort/Confidence/Outlook

New Orders: Manufacturing/Cap-Ex/Exports

Earnings Outlook

Zerohedge, via Goldman Sachs: "Our model estimates that FX boosted the top line of a typical multi-national company by nearly 2.5% in 2011, but that the yoy changes should result in close to a 2.6% headwind this year – a total expected yoy drag of more than 5%. We emphasize the continuation of the FX drag as we enter 3Q, where we model relative 7% yoy deterioration due to FX, based on current spot rates. During the on-going 2Q reporting season several multi-national companies have cited FX as a considerable headwind."

YOY changes assuming current spot rates of 1.23 USD/EUR, 1.56 USD/GBP and JPY/USD 78.60 hold through the rest of the year

No comments:

Post a Comment