I wrote on April 15, 2014 that I thought any dollar strengthening would not happen until the summer and wondered whether I would be smart enough to wait. As the chart of my "progress" for the year shows, I was not. I don't know why, but when I'm not busy doing something, I stare at prices all day. And then I want to trade. Even when I know its bad timing. I need to find a way to break that habit. And overusing leverage. I could have made it out of that trade even or only with a slight loss if I wasn't forced out. I need to use leverage wisely, which I only sometimes do.

On the plus side, I'm still up 25% on the year.

Recent dollar weakness is puzzling. It seems fair value of USD/JPY should be 1.10-1.15 (even without more QE); AUD/USD .80 to .85; EUR??? 1.30? too hard to tell with impact of stress tests on bank lending, the politics surrounding ECB QE and the dormant but extant PI(I)GS crisis; GBP ~ 1.60 according to a trusted source. But it isn't. And has been undervalued and declining for the better part of a year pretty much across the board. Why?

Fundamentals

1) US Trade Balance narrowing thanks to surging oil and gas production (recent months a bit of a trend disruption; that may be because the economy is picking up steam and imports are rising as a result):

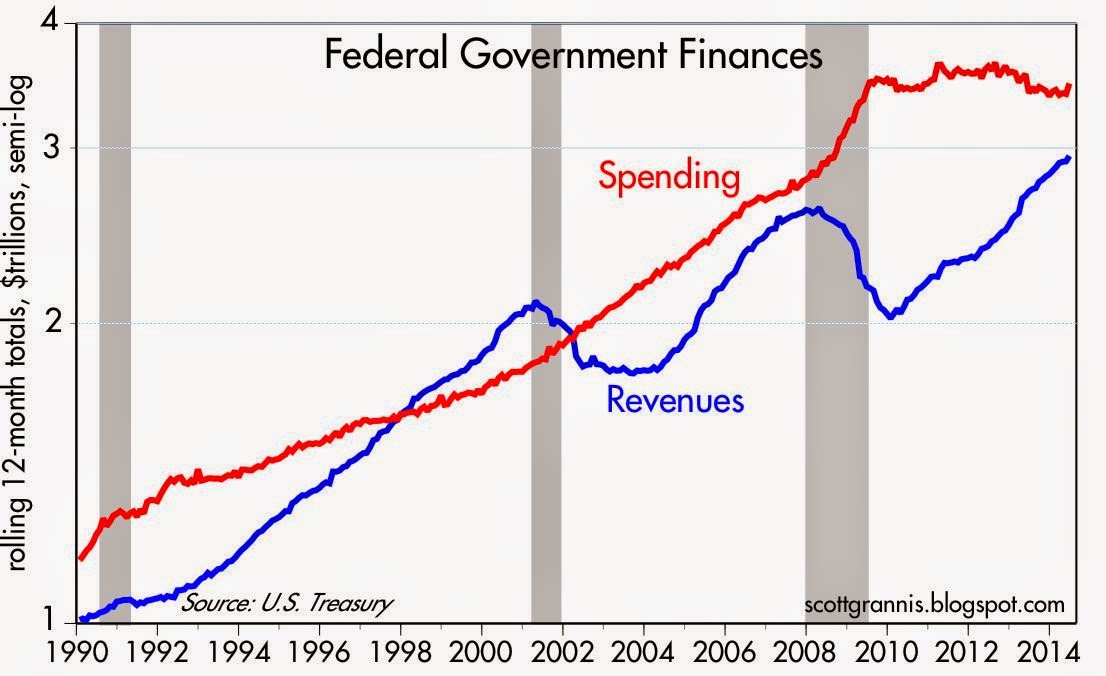

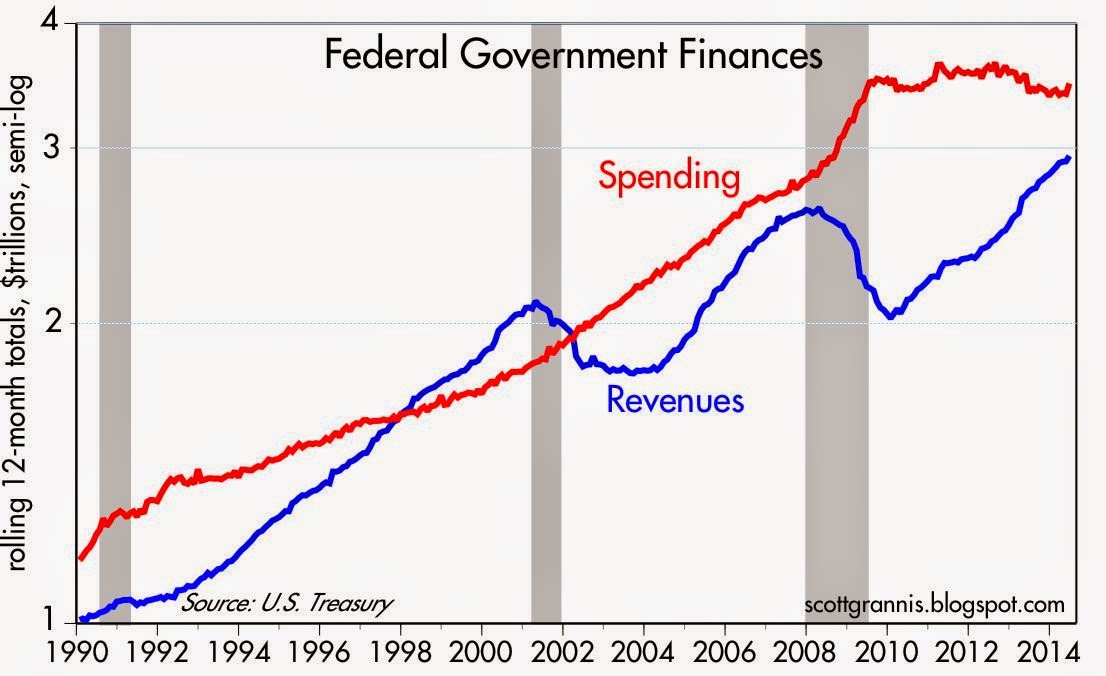

2) Improving US fiscal balance - charts via Scott Grannis (his blog is a must-read, btw)

3) Healthcare inflation finally moderating after decades of runaway growth (further improving the fiscal position of the US government and households) (via bls.gov) but is this Obamacare related? fear of new regulations, idk? We'll see...

4) Economy not doing great, but it is doing well, and also shows signs that things may get much better over the next 1 - 2 years. For example, loans to small businesses are rising briskly (but see this):

Treasury receipts are rising and ISM Manufacturing order backlog is rising - this data point leads employment by a few months:

5) Dollars still dominate the reserves of central banks with a slight increase recently (% of composition of foreign exchange reserves) (data via the IMF):

and the dollar still dominates in international trade and financial markets transactions, also a recent slight increase (via Bank for International Settlements):

Market Positioning

Levered dollar shorts are near extremes in AUD and GBP:

Liquidity (how to analyze?)

Dollar = increases in bank lending - domestic and cross-border in dollars (evidencing increased supply) - could be a reason for USD weakness. Flows in to dollars/USDassets (evidencing increased demand) will come in anticipation of rate hikes, but given the "just around the corner" projection of rate raises over the last 5 years, its possible caution will exist and many wait until very clear signals emerge.

Potential Catalysts

AUD/USD - RBA signalling a rate reduction spurred on by:

1) lower than expected Aussie inflation, growth, employment and/or trade deficits sufficient to make a trend;

2) supported by lower than expected Chinese growth/property prices (sustained trend) (in this same vein, lower commodity prices);

Conclusion

Is US improvement and/or Aussie deterioration going to continue it's second derivative trend? Or are we going to see a moderation in one or both? My inclination is that both will continue at least for now, but it is a hunch based on my amateurish exposure to a limited amount of data, and well as my gut.

Frankly, not everything in Oz is bad: housing is still strong and employment has only moved from strong to fair. It's the outlook that is the reason for my pessimism on AUD: 1) moderating Chinese growth; 2) normalization of steel/iron prices; 3) AUD negative effect on Aussie mfg (Dutch disease); 4) vulnerability to global macro shocks.

With leverage, timing is everything. I wish I had a stronger hunch, but I may just have to sit on the sidelines or, if I do decide to gamble, only dip my toes rather than jumping in head first.

With iron and steel prices normalizing, its hard to see a further increase in AUD above .95. And with the size of levered longs, the market's reaction to a realization of upcoming RBA moves and Aussie weakness will be swift. That's why I'm leaning towards dipping my toes in soon, perhaps even before Tuesday's Aussie inflation numbers come out.

My biggest concern is that "everyone knows" USD is undervalued, which has been a big trade theme since the beginning of this year that hasn't panned out for anyone yet. It would then require a capitulation phase before going my way. Was AUD/USD in early July that moment? It still looks resilient, I don't think so. Had that occurred from March to June? Time to do some more thinking...

On the plus side, I'm still up 25% on the year.

Recent dollar weakness is puzzling. It seems fair value of USD/JPY should be 1.10-1.15 (even without more QE); AUD/USD .80 to .85; EUR??? 1.30? too hard to tell with impact of stress tests on bank lending, the politics surrounding ECB QE and the dormant but extant PI(I)GS crisis; GBP ~ 1.60 according to a trusted source. But it isn't. And has been undervalued and declining for the better part of a year pretty much across the board. Why?

Fundamentals

1) US Trade Balance narrowing thanks to surging oil and gas production (recent months a bit of a trend disruption; that may be because the economy is picking up steam and imports are rising as a result):

2) Improving US fiscal balance - charts via Scott Grannis (his blog is a must-read, btw)

3) Healthcare inflation finally moderating after decades of runaway growth (further improving the fiscal position of the US government and households) (via bls.gov) but is this Obamacare related? fear of new regulations, idk? We'll see...

4) Economy not doing great, but it is doing well, and also shows signs that things may get much better over the next 1 - 2 years. For example, loans to small businesses are rising briskly (but see this):

Treasury receipts are rising and ISM Manufacturing order backlog is rising - this data point leads employment by a few months:

and the dollar still dominates in international trade and financial markets transactions, also a recent slight increase (via Bank for International Settlements):

| Currency distribution of global foreign exchange market turnover: | ||||||||||||

| percentage shares of average daily turnover | ||||||||||||

| 1998 | 2001 | 2004 | 2007 | 2010 | 2013 | |||||||

| Share | Share | Share | Share | Share | Share | |||||||

| USD | 43.4% | 45.5% | 44% | 42.8% | 42.5% | 43.5% | ||||||

Market Positioning

Levered dollar shorts are near extremes in AUD and GBP:

Liquidity (how to analyze?)

Dollar = increases in bank lending - domestic and cross-border in dollars (evidencing increased supply) - could be a reason for USD weakness. Flows in to dollars/USDassets (evidencing increased demand) will come in anticipation of rate hikes, but given the "just around the corner" projection of rate raises over the last 5 years, its possible caution will exist and many wait until very clear signals emerge.

Potential Catalysts

AUD/USD - RBA signalling a rate reduction spurred on by:

1) lower than expected Aussie inflation, growth, employment and/or trade deficits sufficient to make a trend;

2) supported by lower than expected Chinese growth/property prices (sustained trend) (in this same vein, lower commodity prices);

Conclusion

Is US improvement and/or Aussie deterioration going to continue it's second derivative trend? Or are we going to see a moderation in one or both? My inclination is that both will continue at least for now, but it is a hunch based on my amateurish exposure to a limited amount of data, and well as my gut.

Frankly, not everything in Oz is bad: housing is still strong and employment has only moved from strong to fair. It's the outlook that is the reason for my pessimism on AUD: 1) moderating Chinese growth; 2) normalization of steel/iron prices; 3) AUD negative effect on Aussie mfg (Dutch disease); 4) vulnerability to global macro shocks.

With leverage, timing is everything. I wish I had a stronger hunch, but I may just have to sit on the sidelines or, if I do decide to gamble, only dip my toes rather than jumping in head first.

With iron and steel prices normalizing, its hard to see a further increase in AUD above .95. And with the size of levered longs, the market's reaction to a realization of upcoming RBA moves and Aussie weakness will be swift. That's why I'm leaning towards dipping my toes in soon, perhaps even before Tuesday's Aussie inflation numbers come out.

My biggest concern is that "everyone knows" USD is undervalued, which has been a big trade theme since the beginning of this year that hasn't panned out for anyone yet. It would then require a capitulation phase before going my way. Was AUD/USD in early July that moment? It still looks resilient, I don't think so. Had that occurred from March to June? Time to do some more thinking...

जेट प्रिविलेज में हिस्सा बेच सकती है। कंपनी जेट प्रिविलेज में विनिवेश से $50 Cr जुटाएगी

ReplyDeleteEquity Tips