I emptied my futures account on Friday, apparently just in time. I use Etrade, but they use MF Global for futures (I was told they are switching to another futures broker next week when I transferred my funds back to my brokerage account).

It looks like the market saw through the latest "plan" sooner than they have in the past. At the risk of overstating things, it looks like its already starting to unravel.

- 50% Greek bond haircut CDS aren't trigger? Really? That happens and CDS mean next to nothing. Watch as bond yields everywhere rise as a result.

- Even if the Germans want to leverage the EFSF through first-loss insurance and CDS (see last bullet point), who is going to invest? Not the dumb money (China), and the other BRIC's have already ruled it out. ("Why don't you just say, 'want to pour your money down a rat hole?'").

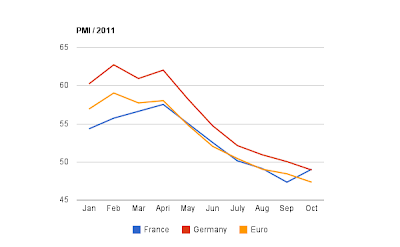

- The euro-economy looks headed for a recession.

- Italian bond yields are still near all-time highs, and look set to continue rising (risk of ECB/SMP coming to the rescue, if they have the balls).

- 2 yr euro swap-spreads are also still at/near all time highs. VIX is rising again and EUR/USD is coming back to earth.

All of this has led me to enter a new trade: Bought EEV at 31.98. I usually like to trade in WTI, but the WTI-Brent spread looks like it may be closing, and I don't have enough information to evaluate it. Let's see how this goes...

It looks like the market saw through the latest "plan" sooner than they have in the past. At the risk of overstating things, it looks like its already starting to unravel.

- 50% Greek bond haircut CDS aren't trigger? Really? That happens and CDS mean next to nothing. Watch as bond yields everywhere rise as a result.

- Even if the Germans want to leverage the EFSF through first-loss insurance and CDS (see last bullet point), who is going to invest? Not the dumb money (China), and the other BRIC's have already ruled it out. ("Why don't you just say, 'want to pour your money down a rat hole?'").

- The euro-economy looks headed for a recession.

- Italian bond yields are still near all-time highs, and look set to continue rising (risk of ECB/SMP coming to the rescue, if they have the balls).

- 2 yr euro swap-spreads are also still at/near all time highs. VIX is rising again and EUR/USD is coming back to earth.

All of this has led me to enter a new trade: Bought EEV at 31.98. I usually like to trade in WTI, but the WTI-Brent spread looks like it may be closing, and I don't have enough information to evaluate it. Let's see how this goes...