Too busy to update graph or explain now, but I closed today @ 89.83, 45% gain.

This blog is not investment advice. My trades contain an unusually high degree of risk, and many of them are losers. You would be foolish to use this blog as investment advice. Videos are at the bottom of the main page. Recommeded reading is in the right side bar. Good movies are below it.

Friday, September 12, 2014

Tuesday, September 9, 2014

Saturday, July 19, 2014

I was right

I wrote on April 15, 2014 that I thought any dollar strengthening would not happen until the summer and wondered whether I would be smart enough to wait. As the chart of my "progress" for the year shows, I was not. I don't know why, but when I'm not busy doing something, I stare at prices all day. And then I want to trade. Even when I know its bad timing. I need to find a way to break that habit. And overusing leverage. I could have made it out of that trade even or only with a slight loss if I wasn't forced out. I need to use leverage wisely, which I only sometimes do.

On the plus side, I'm still up 25% on the year.

Recent dollar weakness is puzzling. It seems fair value of USD/JPY should be 1.10-1.15 (even without more QE); AUD/USD .80 to .85; EUR??? 1.30? too hard to tell with impact of stress tests on bank lending, the politics surrounding ECB QE and the dormant but extant PI(I)GS crisis; GBP ~ 1.60 according to a trusted source. But it isn't. And has been undervalued and declining for the better part of a year pretty much across the board. Why?

Fundamentals

1) US Trade Balance narrowing thanks to surging oil and gas production (recent months a bit of a trend disruption; that may be because the economy is picking up steam and imports are rising as a result):

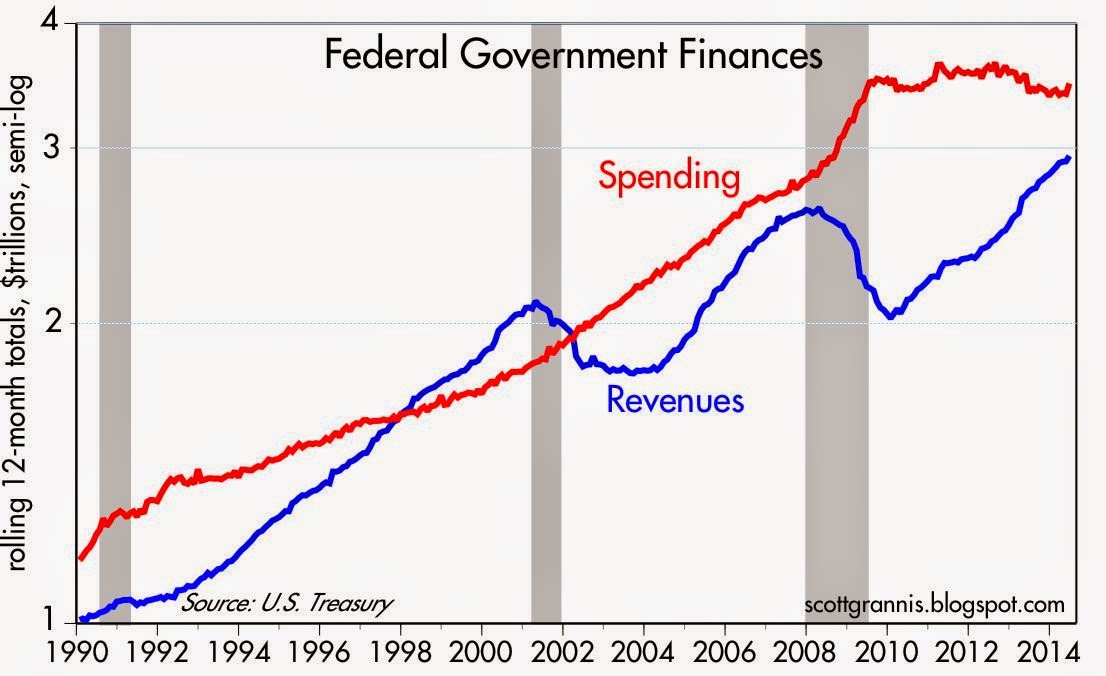

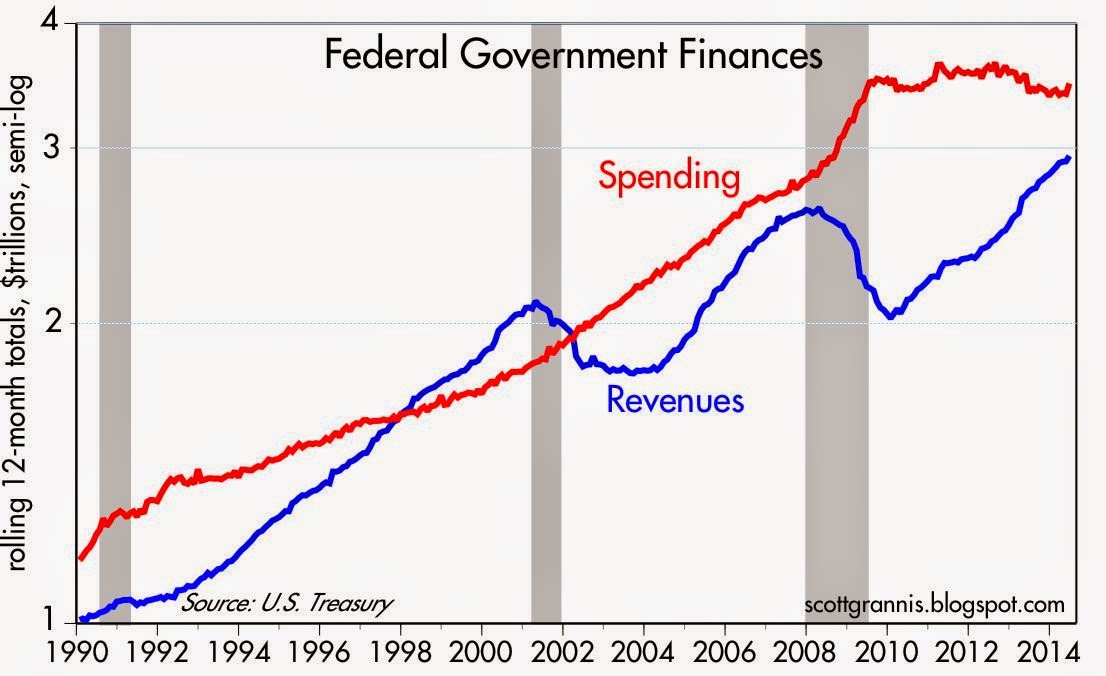

2) Improving US fiscal balance - charts via Scott Grannis (his blog is a must-read, btw)

3) Healthcare inflation finally moderating after decades of runaway growth (further improving the fiscal position of the US government and households) (via bls.gov) but is this Obamacare related? fear of new regulations, idk? We'll see...

4) Economy not doing great, but it is doing well, and also shows signs that things may get much better over the next 1 - 2 years. For example, loans to small businesses are rising briskly (but see this):

Treasury receipts are rising and ISM Manufacturing order backlog is rising - this data point leads employment by a few months:

5) Dollars still dominate the reserves of central banks with a slight increase recently (% of composition of foreign exchange reserves) (data via the IMF):

and the dollar still dominates in international trade and financial markets transactions, also a recent slight increase (via Bank for International Settlements):

Market Positioning

Levered dollar shorts are near extremes in AUD and GBP:

Liquidity (how to analyze?)

Dollar = increases in bank lending - domestic and cross-border in dollars (evidencing increased supply) - could be a reason for USD weakness. Flows in to dollars/USDassets (evidencing increased demand) will come in anticipation of rate hikes, but given the "just around the corner" projection of rate raises over the last 5 years, its possible caution will exist and many wait until very clear signals emerge.

Potential Catalysts

AUD/USD - RBA signalling a rate reduction spurred on by:

1) lower than expected Aussie inflation, growth, employment and/or trade deficits sufficient to make a trend;

2) supported by lower than expected Chinese growth/property prices (sustained trend) (in this same vein, lower commodity prices);

Conclusion

Is US improvement and/or Aussie deterioration going to continue it's second derivative trend? Or are we going to see a moderation in one or both? My inclination is that both will continue at least for now, but it is a hunch based on my amateurish exposure to a limited amount of data, and well as my gut.

Frankly, not everything in Oz is bad: housing is still strong and employment has only moved from strong to fair. It's the outlook that is the reason for my pessimism on AUD: 1) moderating Chinese growth; 2) normalization of steel/iron prices; 3) AUD negative effect on Aussie mfg (Dutch disease); 4) vulnerability to global macro shocks.

With leverage, timing is everything. I wish I had a stronger hunch, but I may just have to sit on the sidelines or, if I do decide to gamble, only dip my toes rather than jumping in head first.

With iron and steel prices normalizing, its hard to see a further increase in AUD above .95. And with the size of levered longs, the market's reaction to a realization of upcoming RBA moves and Aussie weakness will be swift. That's why I'm leaning towards dipping my toes in soon, perhaps even before Tuesday's Aussie inflation numbers come out.

My biggest concern is that "everyone knows" USD is undervalued, which has been a big trade theme since the beginning of this year that hasn't panned out for anyone yet. It would then require a capitulation phase before going my way. Was AUD/USD in early July that moment? It still looks resilient, I don't think so. Had that occurred from March to June? Time to do some more thinking...

On the plus side, I'm still up 25% on the year.

Recent dollar weakness is puzzling. It seems fair value of USD/JPY should be 1.10-1.15 (even without more QE); AUD/USD .80 to .85; EUR??? 1.30? too hard to tell with impact of stress tests on bank lending, the politics surrounding ECB QE and the dormant but extant PI(I)GS crisis; GBP ~ 1.60 according to a trusted source. But it isn't. And has been undervalued and declining for the better part of a year pretty much across the board. Why?

Fundamentals

1) US Trade Balance narrowing thanks to surging oil and gas production (recent months a bit of a trend disruption; that may be because the economy is picking up steam and imports are rising as a result):

2) Improving US fiscal balance - charts via Scott Grannis (his blog is a must-read, btw)

3) Healthcare inflation finally moderating after decades of runaway growth (further improving the fiscal position of the US government and households) (via bls.gov) but is this Obamacare related? fear of new regulations, idk? We'll see...

4) Economy not doing great, but it is doing well, and also shows signs that things may get much better over the next 1 - 2 years. For example, loans to small businesses are rising briskly (but see this):

Treasury receipts are rising and ISM Manufacturing order backlog is rising - this data point leads employment by a few months:

and the dollar still dominates in international trade and financial markets transactions, also a recent slight increase (via Bank for International Settlements):

| Currency distribution of global foreign exchange market turnover: | ||||||||||||

| percentage shares of average daily turnover | ||||||||||||

| 1998 | 2001 | 2004 | 2007 | 2010 | 2013 | |||||||

| Share | Share | Share | Share | Share | Share | |||||||

| USD | 43.4% | 45.5% | 44% | 42.8% | 42.5% | 43.5% | ||||||

Market Positioning

Levered dollar shorts are near extremes in AUD and GBP:

Liquidity (how to analyze?)

Dollar = increases in bank lending - domestic and cross-border in dollars (evidencing increased supply) - could be a reason for USD weakness. Flows in to dollars/USDassets (evidencing increased demand) will come in anticipation of rate hikes, but given the "just around the corner" projection of rate raises over the last 5 years, its possible caution will exist and many wait until very clear signals emerge.

Potential Catalysts

AUD/USD - RBA signalling a rate reduction spurred on by:

1) lower than expected Aussie inflation, growth, employment and/or trade deficits sufficient to make a trend;

2) supported by lower than expected Chinese growth/property prices (sustained trend) (in this same vein, lower commodity prices);

Conclusion

Is US improvement and/or Aussie deterioration going to continue it's second derivative trend? Or are we going to see a moderation in one or both? My inclination is that both will continue at least for now, but it is a hunch based on my amateurish exposure to a limited amount of data, and well as my gut.

Frankly, not everything in Oz is bad: housing is still strong and employment has only moved from strong to fair. It's the outlook that is the reason for my pessimism on AUD: 1) moderating Chinese growth; 2) normalization of steel/iron prices; 3) AUD negative effect on Aussie mfg (Dutch disease); 4) vulnerability to global macro shocks.

With leverage, timing is everything. I wish I had a stronger hunch, but I may just have to sit on the sidelines or, if I do decide to gamble, only dip my toes rather than jumping in head first.

With iron and steel prices normalizing, its hard to see a further increase in AUD above .95. And with the size of levered longs, the market's reaction to a realization of upcoming RBA moves and Aussie weakness will be swift. That's why I'm leaning towards dipping my toes in soon, perhaps even before Tuesday's Aussie inflation numbers come out.

My biggest concern is that "everyone knows" USD is undervalued, which has been a big trade theme since the beginning of this year that hasn't panned out for anyone yet. It would then require a capitulation phase before going my way. Was AUD/USD in early July that moment? It still looks resilient, I don't think so. Had that occurred from March to June? Time to do some more thinking...

Friday, May 2, 2014

I may be up shit creek on this trade

Lots of leverage on AUD/USD short after this mornings NFP came better than expected: June '14 @ .9212. I wanted to do it before the data came out, but uncharacteristic of me, I waited for the data...bad move.

And bad move to get in so quick. The market is not reacting as I thought it would and I don't quite know why...buy the rumor sell the news? Only a one-off data point and not a trend? Won't change Fed's timetable? All of the above? I feel like I'm totally missing something though...

So the Yen is stronger across the board and the dollar is weaker across the board. I'd like to figure out why. I hope to this weekend. As of now, I will maintain half the position because I think 1) China data will continue to weaken over the short and medium term; 2) RBA will not feed the hawks (unfortunately for Aussie mfg., I'm not sure they're ready to feed the doves either). I will watch data closely next week and reevaluate.

Russia likely to intervene/invade (depending if your Russian or Western) in Eastern Ukraine in the next couple weeks. Not sure if/how this will affect AUD/USD...risk off, sure, but how much will depend on how bellicose the rhetoric is surrounding the West's reaction and Russia's counterreaction.

Biggest data points next week for AUD/USD:

Monday - 9 am CST - US ISM

- 830 pm CST - balance of trade, imports/exports

Tuesday - 730 am CST - US balance of trade

- 830 pm CST - retail sales

- 845 pm CST - Chinese HSBC non-mfg

Wednesday - 830 pm CST - Employment change

- 9 pm CST - Chinese balance of trade, imports/exports

Thursday - 830 pm CST -

1) RBA Monetary Policy Statement

2) Chinese inflation data

UPDATE: Cut losses. Too much leverage and not enough patience. Loss slightly over 60%. Taking the remainder (still up a bit for the year) and investing in to law practice. But I'll be back with more patience and more perspective.

And bad move to get in so quick. The market is not reacting as I thought it would and I don't quite know why...buy the rumor sell the news? Only a one-off data point and not a trend? Won't change Fed's timetable? All of the above? I feel like I'm totally missing something though...

So the Yen is stronger across the board and the dollar is weaker across the board. I'd like to figure out why. I hope to this weekend. As of now, I will maintain half the position because I think 1) China data will continue to weaken over the short and medium term; 2) RBA will not feed the hawks (unfortunately for Aussie mfg., I'm not sure they're ready to feed the doves either). I will watch data closely next week and reevaluate.

Russia likely to intervene/invade (depending if your Russian or Western) in Eastern Ukraine in the next couple weeks. Not sure if/how this will affect AUD/USD...risk off, sure, but how much will depend on how bellicose the rhetoric is surrounding the West's reaction and Russia's counterreaction.

Biggest data points next week for AUD/USD:

Monday - 9 am CST - US ISM

- 830 pm CST - balance of trade, imports/exports

Tuesday - 730 am CST - US balance of trade

- 830 pm CST - retail sales

- 845 pm CST - Chinese HSBC non-mfg

Wednesday - 830 pm CST - Employment change

- 9 pm CST - Chinese balance of trade, imports/exports

Thursday - 830 pm CST -

1) RBA Monetary Policy Statement

2) Chinese inflation data

UPDATE: Cut losses. Too much leverage and not enough patience. Loss slightly over 60%. Taking the remainder (still up a bit for the year) and investing in to law practice. But I'll be back with more patience and more perspective.

Tuesday, April 29, 2014

Short EUR/USD

Short Jun '14 @ 1.3820

Lower German inflation gives ECB more ability to QE, which they were likely to do anyways, this just makes it easier. As will trouble from Ukraine, which is about as certain as anything can be.

Expectations for US jobs are pretty high, so there's room for disappointment...biggest risk to this trade. FOMC will likely be 'stay the course.'

Target is...I don't know. It depends on how long I want to hold this trade. I may take it for the initial leg down, then try it short it again after a rebound.

UPDATE: stopped out at 1.3820 after EU inflation numbers. I have no stomach to be the wrong way. Lack of conviction? On timing, I think so. EU inflation numbers won't push ECB to QE before AQR is done...but when will it be expected? I'm going to watch ADP numbers this morning...thinking AUD/USD may be closer.

UPDATE2: and so I did. Q1 GDP came in at .1%, far lower than expectations. Everything jumped on the news, but was overdone. Used moderate leverage to short AUD/USD on the snapback @ 92.48, covered at 92.34. Gain of 4.7%. Will be watching tonight's Aussie and Chinese data...

Lower German inflation gives ECB more ability to QE, which they were likely to do anyways, this just makes it easier. As will trouble from Ukraine, which is about as certain as anything can be.

Expectations for US jobs are pretty high, so there's room for disappointment...biggest risk to this trade. FOMC will likely be 'stay the course.'

Target is...I don't know. It depends on how long I want to hold this trade. I may take it for the initial leg down, then try it short it again after a rebound.

UPDATE: stopped out at 1.3820 after EU inflation numbers. I have no stomach to be the wrong way. Lack of conviction? On timing, I think so. EU inflation numbers won't push ECB to QE before AQR is done...but when will it be expected? I'm going to watch ADP numbers this morning...thinking AUD/USD may be closer.

UPDATE2: and so I did. Q1 GDP came in at .1%, far lower than expectations. Everything jumped on the news, but was overdone. Used moderate leverage to short AUD/USD on the snapback @ 92.48, covered at 92.34. Gain of 4.7%. Will be watching tonight's Aussie and Chinese data...

Tuesday, April 15, 2014

Trade ideas

I know what, but I don't know exactly when. I want to short AUD/USD, but don't think its ready until summer. Same for EUR/USD. Later in the year for GBP/USD.

USD/JPY is have long, and I think earlier than the above. But when? Hard to say, as I don't think that the BOJ will actually start QE until summer, but I do think it's highly anticipated, so I don't know that the market will wait that long.

I think the smartest thing to do now is just wait as I think equities will move down sharply Q2, and larger currency moves summer + this year. Let's see if I'm smart enough to wait, lol.

USD/JPY is have long, and I think earlier than the above. But when? Hard to say, as I don't think that the BOJ will actually start QE until summer, but I do think it's highly anticipated, so I don't know that the market will wait that long.

I think the smartest thing to do now is just wait as I think equities will move down sharply Q2, and larger currency moves summer + this year. Let's see if I'm smart enough to wait, lol.

Wednesday, April 9, 2014

New trade

AUD spiked on employment news that was worse than it looked on the surface (strong part-time job gains, large full-time job losses; lower unemployment rate, but a lower participation rate), so shorting seemed an interesting prospect once the much worse than expected Chinese trade data came out. I expect this to be a very short-term trade with minimal gain or loss; I still think the uptrend is intact (or at least not ready for a reversal just yet).

Short 6A (AUD/USD futures) June '14 contract @ 93.79

Stopped out at 93.79. I don't have time to keep playing with it, so I'm moving on for now.

Short 6A (AUD/USD futures) June '14 contract @ 93.79

Stopped out at 93.79. I don't have time to keep playing with it, so I'm moving on for now.

Tuesday, April 8, 2014

Not so sure AUD is set to go lower just yet

I still don't have a trade idea, and don't want to just dick around in the markets...I'm far too busy now for that anyways. I think AUD is a good short, but I don't think its had it's last run yet. Oil is too volatile and unpredictable with Ukraine and ME concerns laid over a backdrop of slow Western growth, more efficient vehicles and increasing US oil and gas production. GBP is overvalued and their property bubble is getting a bit silly, but I don't see a catalyst for a reversal (then again, I'm not looking too hard at that one). JPY should be going lower, but now the BOJ seems to be balking at additional QE. EUR seems overvalued on both Ukraine and likely (eventual) additional QE, but as the ECB's balance sheet decreases with repayment of LTRO's, I won't touch it without an indication of QE and/or continuation and need for new LTRO's (expire/repayment by December I think). S&P looks topped out, momo stocks are finally taking a hit, but I've seen these corrections before; without a catalyst, I don't see a market correction coming soon enough to justify shorting after the few days of drops we've had. There's still alot of stupid out there willing to buy more exciting momo stocks at + 50x p/e and utterly stupid business models (getting people to pay for games that would have sucked even in the 80's, etc.).

I think I'm going to wait for something more obvious. In the meantime, here is my reasoning on my most recent trade idea (that is on the back burner for now, UNLESS of course tomorrow's FOMC minutes and Aussie employment numbers suggest to do the opposite):

Reasoning for short-term stability/rise in AUD:

1) anticipated Chinese stimulus in Q2, even though I think markets will be disappointed;

2) a less-hawkish FOMC Minutes release tomorrow;

3) a short rebound in Aussie economy, and a general expectation of a return to normalcy, and iron ore prices recovering (a big dead cat bounce);

4) commitment of traders indicating a shifting of positions from short to long, but not so far as to create a snap-back yet;

5) From the RBA's perspective, a housing bubble that may not be compatible with low interest rates and a weak currency (I'm suggesting they'd rather let the air out, not pop it).

I don't think the fundamentals look good for AUD medium-term, though:

1) Chinese rebalancing is moving forward, and with it, slower growth and less need for iron/copper/etc. imports (that's not even considering the possibility of larger defaults in China causing runs, while likely to be controlled as to extent and duration, will still hit confidence and growth);

2) normalization of Fed policy (but I've been surprised before...);

3) Aussie housing bubble bursting, along with other credit (see below). It is awfully reminiscent of the U.S. housing bubble;

4) Once popped, the RBA will likely go dovish (for the RBA that is, not necessarily like the Fed).

5) current high value of AUD has and is negatively impacting exporters (e.g., car manufacturers packing up and gone by 201?6?), and with it employment.

via macrobusiness.com.au

via macrobusiness.com.au

via macrobusiness.com.au

I think I'm going to wait for something more obvious. In the meantime, here is my reasoning on my most recent trade idea (that is on the back burner for now, UNLESS of course tomorrow's FOMC minutes and Aussie employment numbers suggest to do the opposite):

Reasoning for short-term stability/rise in AUD:

1) anticipated Chinese stimulus in Q2, even though I think markets will be disappointed;

2) a less-hawkish FOMC Minutes release tomorrow;

3) a short rebound in Aussie economy, and a general expectation of a return to normalcy, and iron ore prices recovering (a big dead cat bounce);

4) commitment of traders indicating a shifting of positions from short to long, but not so far as to create a snap-back yet;

5) From the RBA's perspective, a housing bubble that may not be compatible with low interest rates and a weak currency (I'm suggesting they'd rather let the air out, not pop it).

I don't think the fundamentals look good for AUD medium-term, though:

1) Chinese rebalancing is moving forward, and with it, slower growth and less need for iron/copper/etc. imports (that's not even considering the possibility of larger defaults in China causing runs, while likely to be controlled as to extent and duration, will still hit confidence and growth);

2) normalization of Fed policy (but I've been surprised before...);

3) Aussie housing bubble bursting, along with other credit (see below). It is awfully reminiscent of the U.S. housing bubble;

4) Once popped, the RBA will likely go dovish (for the RBA that is, not necessarily like the Fed).

5) current high value of AUD has and is negatively impacting exporters (e.g., car manufacturers packing up and gone by 201?6?), and with it employment.

via macrobusiness.com.au

via macrobusiness.com.au

via macrobusiness.com.au

Friday, March 7, 2014

Don't think the turbulence with Ukraine is over yet

Things continue to develop in a negative way, including the U.S. moving more military equipment (over 100 fighters total known) to Eastern Europe, the Aegean and Black Seas (CVN-77 carrier battle group in Aegean, destroyer in Black Sea), as well as continued Russian advancements in Crimea and Eastern Ukraine (directly and through proxies). Putin's speech the other day was not a white flag; he was merely making his case to the West, particularly Europe. While he may have been outmaneuvered that day, he's not done yet. Crimea will vote to join Russia...will/how Russia accept, and what will the new Ukrainian government do, and if Ukr.govt responds with anything other than protesting at the U.N., how willing is the West to back them up? So far eastern Ukrainian provinces have rebuffed pro-Moscow moves in that direction...how much harder is Putin willing to try? I suspect a little more...

I don't think we will see a hot war soon (if at all, it will be undeclared, and everyone will try to give the other a face-saving way out -- even Putin doesn't want a direct confrontation), but everyone's military in close proximity with undisciplined militia-type groups running around makes for a tinderbox looking for a spark, especially once the Crimean vote happens.

I want to make a bet, but there's no way to determine if/when the situation will escalate, so I want a bet that I can hang on to long-term. AUD/USD seems like the best one given fundamentals (risk to this bet is the recent comments by RBA re: maintaining interest rates and "jawboning," so any data that would keep them on hold; generally positive from Australian and/or negative data from U.S; any positive growth/outlook from Chinese fixed-asset investment/postponing of rebalancing; expanding credit growth in China ). I don't think the AUD is ready for another leg down yet (inevitable, but when?), I just think this is the safest way to make a leveraged bet.

I'm hoping this to be a short-term trade, gain or loss, and it is not with alot of leverage. I'm hoping for events/saber-rattling near-term, and I plan on dumping when that happens, as both sides will then try to keep the situation from escalating (how many times can I play this fiddle? we'll see...).

Short June14 AUD/USD futures at 90.15.

UPDATE: No new Ukraine news over the weekend but alot of bad Chinese trade data, without alot of movement in AUD/USD. Maybe its not ready yet, so I'm closing out for now with a small gain. Closed at 89.59, gain of 5.9%.

I don't think we will see a hot war soon (if at all, it will be undeclared, and everyone will try to give the other a face-saving way out -- even Putin doesn't want a direct confrontation), but everyone's military in close proximity with undisciplined militia-type groups running around makes for a tinderbox looking for a spark, especially once the Crimean vote happens.

I want to make a bet, but there's no way to determine if/when the situation will escalate, so I want a bet that I can hang on to long-term. AUD/USD seems like the best one given fundamentals (risk to this bet is the recent comments by RBA re: maintaining interest rates and "jawboning," so any data that would keep them on hold; generally positive from Australian and/or negative data from U.S; any positive growth/outlook from Chinese fixed-asset investment/postponing of rebalancing; expanding credit growth in China ). I don't think the AUD is ready for another leg down yet (inevitable, but when?), I just think this is the safest way to make a leveraged bet.

I'm hoping this to be a short-term trade, gain or loss, and it is not with alot of leverage. I'm hoping for events/saber-rattling near-term, and I plan on dumping when that happens, as both sides will then try to keep the situation from escalating (how many times can I play this fiddle? we'll see...).

Short June14 AUD/USD futures at 90.15.

UPDATE: No new Ukraine news over the weekend but alot of bad Chinese trade data, without alot of movement in AUD/USD. Maybe its not ready yet, so I'm closing out for now with a small gain. Closed at 89.59, gain of 5.9%.

Wednesday, February 5, 2014

Best trade yet

Well I figured it would fall fast, especially on what looked to be an inevitable warning on profits (all the other 3-D printers had already done the same), but today's action surprised me. Decided to take profits. Glad I bought puts instead of shorting, lol. Total gain of 405%, even better than my silver trade. I'm looking for my next trade to be long (no way!) either S&P or an emerging market (have been beaten up pretty badly, should be good for a bounce...but then again, I may not for a while as the flood of money heading home may have just begun).

Monday, February 3, 2014

I'm back, baby!

Having taken a hiatus from trading to start a business (failed) and start a law practice (working out well so far), I decided to dip my toes back in to the pool. I've hesitated putting money at risk for a while, but when I saw DDD, I couldn't stop myself.

I like to bet on things falling, mostly because it's the opposite of what most other people are doing. It's my personal bias, and I try and control it as much as possible. DDD is an interesting company, but not at 200x P/E. Parabolic moves inevitably do the same thing the other way, and it becomes pretty easy to bet against. My most successful trade by far was shorting silver when it went parabolic in 2011. I made this move on 12/26/13, buying the May 17, 2014 put at $40 strike, avg. price of $0.377 per contract. In retrospect, I should have shorted the stock, but too late now...

As long as the broader market is in correction mode, I think the price will continue to plummet (10-15% correction). Near-term, I'm looking at around $60-ish. We'll see what the option price looks like at that point; I'm guessing around $0.70-ish.

I like to bet on things falling, mostly because it's the opposite of what most other people are doing. It's my personal bias, and I try and control it as much as possible. DDD is an interesting company, but not at 200x P/E. Parabolic moves inevitably do the same thing the other way, and it becomes pretty easy to bet against. My most successful trade by far was shorting silver when it went parabolic in 2011. I made this move on 12/26/13, buying the May 17, 2014 put at $40 strike, avg. price of $0.377 per contract. In retrospect, I should have shorted the stock, but too late now...

As long as the broader market is in correction mode, I think the price will continue to plummet (10-15% correction). Near-term, I'm looking at around $60-ish. We'll see what the option price looks like at that point; I'm guessing around $0.70-ish.

Subscribe to:

Posts (Atom)